Published Nov 14, 2024 by Uche Emordi

Top 10 Ways To Invest in Real Estate in Nigeria

Estates

26 mins read

10 Things You Should Know About Real Estate Investment in Nigeria

The Opportunity in Real Estate Investment in Nigeria: Nigeria, a country of over 200million people has a housing deficit of 17-21million.

With an ever increasing population growth, Nigeria is a prime investment destination, a ready market for various investments; tech, financial services and real estate investments.

But when we talk about real estate investment in Nigeria there is a need for us to realize and appreciate the peculiarity of our situation here in Nigeria.

If you don't realize, understand or appreciate our peculiarity and try to paint Real Estate investment in Nigeria with the same brush as is done in other climes - you may run into problems.

This post is going to show you how to make a lot of money from Real Estate Investment in Nigeria or how you can alternatively save a lot of money from your Real Estate investment deals - because a lot can go wrong in a hurry.

What is Real Estate Investment?

Real estate is as old as God’s green earth and ever since man started cultivating land and marking territory - the accompanying commerce that ensued in some way or form or manner around using that piece of earth to make profits and all the activities carried out in said land - gave birth to Real Estate Investment.

If you go back to the basic economic principles - you’d realize from the four factors of production;

- Land

- Labour

- Capital

- Enterpreneurship,

Sitting at the top is; land. Traditionally, you could not start any form of business and undertake commerce without land.

Real Estate Investment is Big Business in Nigeria

Nigeria as a Real Estate investment destination Real Estate is worthwhile - with a ready hungry market that you can take advantage of! But you must look at it as a business - with the aim of making profit. That is how to succeed!

The Opportunity in Real Estate Investment in Nigeria:

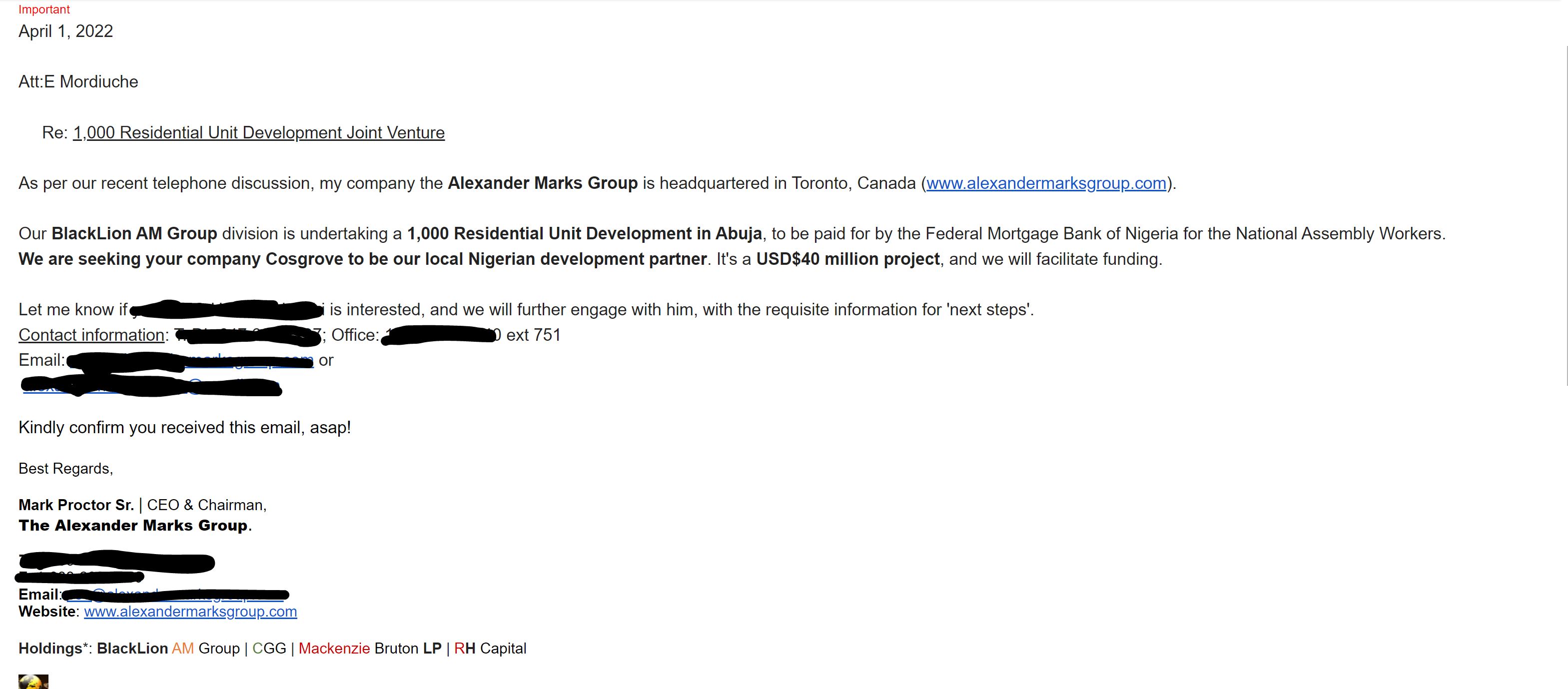

This is an example of the kind of emails I receive; a $40milion fully funded Real Estate project request from a Private Equity firm in Toronto Canada seeking for a contractor partner in Abuja.

This post is going to show you how to make a lot of money from Real Estate Investment in Nigeria or how you can alternatively save a lot of money from your Real Estate investment deals - because a lot can go wrong in a hurry.

If you want to invest in Real Estate or start a real estate business here in Nigeria, these are not ‘nice to haves’, but things you should definitely pay attention to:

1.) Learn from Successful Real Estate Companies, Businesses and Developers in Nigeria

If you want to dive into how to make successful real estate investments in Nigeria - it goes without saying that you have to look at some successful real estate companies and developers in Nigeria.

You have to study how they have done their real estate investments and stayed successful for years in Nigeria. Despite the numerous challenges they have somehow managed to not only stay afloat but thrive.

The likes of these companies and developers are such as;

- Mixta Africa

- Landwey,

- Rendeavour

- UPDC.

- Cosgrove

- First World Communities

- Brains and Hammers etc

If you want to invest in Real Estate or start a real estate business here in Nigeria, you should definitely pay attention to what they are doing. I can tell you that they are getting a lot of things right.

I have learned a lot about Real Estate just observing how these Real Estate companies have done business and real estate investment in Nigeria.

I’ve learned more from them than in any book or school.

If you want to invest in Real Estate in Nigeria, Click to Call us, or Send a Whatsapp message, or Email us.

2.) Choose The Right Real Estate Investment Strategy

Broadly speaking they are four (4) major Real Estate investment strategies:

i.) Rentals:

Rentals are one of the oldest, safest, and most steady source of income from Real Estate.

In Rentals, you buy a property to put on the market for monthly or yearly rental.

It has a lot of upsides like; regular cash flow, asset appreciation, collateral for loans, and property can be sold afterward for a profit.

The downside is that just like in many numerous Lekki and Banana island apartments, you may experience non-subscription of your apartment for long periods.

But a hot axis like Osapa London has very few empty units.

A company like First World Communities handles rentals in a prime place like Abijo and a 3 bedroom flat there goes for NGN1.2m per year with a property worth of 25m.

Dangote has taken out a lease for over 50 units and you can make guaranteed rental income of NGN800,000 per annum by buying these properties as a rental investment.

In a place like Kubwa Abuja - it is a low and middle income neighorhood so you can get bulk land here and sell for cheap.

To find out more about rental investments, in Nigeria Click to Call us, or Send a Whatsapp message, or Email us.

ii.) Flipping of land and Houses:

Also referred to as land/property banking - you purchase a property to sell in the quickest time possible for profit.

A company that works well with this strategy is Gracias Global in Lagos.They have prime properties all around Lagos in Sangotedo, Eleko, Ibadan and some of these properties, with strategic locations like in Eleko junction.

They have the gracias Morganite, Goldstone and Peridot heights, off lekki epe expressway Lagos.

Gracias Global's major Real Estate investment strategy is buying and reselling land whilst providing infrastructure around the residential and commercial development.

They can see as much as over 100% ROI because they actually buy this land for cheap from Omonile, by doing 'sponsorships deals'.

Another company that uses this strategy of flipping is; Landwey Investment Limited also located in Lagos as well.

Word on the street was that the total payout for westwood estate by Landwey in Monastery road Sangotedo, Lagos; was NGN3billion.

Nowadays though, Landwey is majorly into property development and that is the next Real Estate Investment strategy we would talk about.

iii.) Property Development

Property development involves purchasing land, erecting buildings, developing infrastructure, and selling to the buyer either at carcass (lintel level), fully finished, with fittings, plumbings, and so on, or fully finished and furnished.

This arguably can be the most profitable strategy and companies like Cosgrove in Abuja with their flagship fully finished and furnished property in Wuye costing NGN500million.

A company like Landwey started with flipping lands but after they started their first developments in Abraham Adesanaya - the Urban Prime Estates - each unit reportedly cost between 14m-18m and they sold for as much NGN40million and above per unit.

After the success of the Urban Prime Estates - Landwey has never looked back and have majorly been into property development these last few years.

They currently have a 100m 5 bedroom property in Abijo, Eko Ekete. How crazy? The more mind-blowing fact is that it is off-plan (not yet built).

But property development is capital intensive and it requires alot to position for success.

For example Gracias Global as mentioned above, started years before Landwey and although they have tried their hands on many development projects like the Goldstone, Peridot Heights all in Sangotedo, they haven’t been as successful as Landwey with development.

They seem to have realized their competitive advantage and stuck with flipping properties; selling land in only prime areas in Lagos and Ibadan.

UPDC has a monolopoly in various areas around Lagos, like Festac and Osapa London where they developed the popular Pinnock beach estate with plots of land for sale ranging from NGN180,000,00-NGN320,000,000

If you want to invest in Real Estate in Nigeria, Click to Call us, or Send a Whatsapp message, or Email us.

There is another less talked about Real Estate Investment strategy: Real Estate Investment Trusts (REITS).

iv.) REITS:

Simply put, a REIT is a trust that pools funds from individual investors, acquires, operates and/or manages income-generating real estate.

There are different types of REITS like Equity REITS, and Mortgage REITS. These REITS, listed in the Nigerian Stock Exchange distributes the income derived from their owned properties and investments as dividends to subscribers.

REITs are traded on the Nigerian Stock Exchange (NGX) just like stocks; you can buy or sell REITs through stockbrokers.

There are currently only 3 registered REITS recognized by the Securities and Exchange Commission namely; Union Homes, Skye Shelters and UPDC, a subsidiary of UACN. UPDC are the developers of the Popular Pinnock Beach Estate

Nigeria by 2019 had the market cap of REITS at NGN32-72bn, compared with South Africa which has a total market cap of over $31.42 billion of 31 REITS.

For even better context the combined market capitalization of the three REITs in Nigeria is US$131 Million while in the United States, the combined market capitalization of REITs is around US$898.41billion.

REITS have been very challenging to implement in Nigeria, and even a major REIT - UPDC, a subsidiary of UACN posted a loss last year.

So you can see that whatever strategy from the above you choose namely;

i.) Rentals ii.)Flipping Houses/Land iii.)Property development iv.) REITs,

You have to position yourself for success because it isn’t a walk in the park.

If you want to invest in Real Estate in Nigeria, Click to Call us, or Send a Whatsapp message, or Email us.

But how do you choose the right Real Estate Investment Strategy in Nigeria? How do you implement your strategy successfully?

Keep reading:

The Ultimate Real Estate Investment Checklist

3.) Understand the Role of the government:

The role of government is very heavy in Nigeria.

When motorcycle ride hailing technology entered into the market it took just a simple announcement to squash investments and livelihoods.

Companies had raised millions of investor dollars, and it was over in one day. They had to pivot to logistics.

Now to even emphasize the role of government in this industry, per the Land Use Act, it empowers the governor to have unfettered access to all land in the state.

So the governor has to approve every single land transaction for it to become legally binding.

If you do not understand this or the role the government plays in rectification, ratification, giving titles, and approving transactions, you’ll get into trouble.

It is no wonder the likes of Wale of Landwey, Sujibomi Ogundele of Sujimoto, Cosgrove's Ceo are always pictured with the governor and top government officials.

Befriending government, government agencies, officials and following due process in the land bureau is a required strategy here depending on how high you want to fly.

If you want to invest in Real Estate in Nigeria, Click to Call us, or Send a Whatsapp message, or Email us.

4.) Understand land laws and titles

Following from the above - you should be aware that legally binding property transactions can only be done on a properly titled property registered at the state’s registry.

The major title you should always look out for is the C of O. The certificate of occupancy is a document that confirms the lease of a piece of land to an individual for 99 years.

Other land titles you should know are:

i.) Governor’s consent: a governor’s consent can be considered as a title because it confers authenticity on a land. Like the name implies, it is a duly signed and stamped deed of assignment by the governor of the state.

This shows that a land with a C of O title has been transferred to another owner duly recognized and backed by the state and power of the governor.

Other useful titles to note are:

ii.) Excision: Excision is the process by which the government carves out areas in places it deems urban areas and officially releases and recognizes the ancestral owners as the lawful owners of that portion.

iii.) Gazette: This excised portion is subsequently recorded in the government's official journal called the gazette. This is a recognized land title.

NB: A registered survey is not a title. Also, a'freehold' land isn’t a title as well. But a freehold and a registered survey is free from government acquisition and processing of C of O/ perfecting of the title is possible.

Per the land law, if land is not registered or the survey lodged in the Land's bureau and duly approved by the governor - through the C of O or allocation - you have no enforceable legal right over it.

If you want to invest in Real Estate in Nigeria, Click to Call us, or Send a Whatsapp message, or Email us.

5.) Choose The Right Location - It is everything

The popular saying goes; real estate is all about location location location!

This fact is not any different here in Nigeria.

Whichever strategy you choose; the most important decision you would make is the location!

How to Choose The Right Location For Your Real Estate Investment

The right property in a prime location sells itself.

Property Development in Prime Locations:

One thing that prime locations do for you is that your property sells itself. Mabushi - the city center, Katampe phase 1 and 2 close to the airport and facing a major road and Maitama are major prime locations in Abuja Cosgrove is in.

But the thing about prime locations is that they are expensive. Very expensive.

So what happens if you do not have the budget for a prime location? Then consider areas that share boundaries with these prime areas.

Lagos Case Study

In Lagos, Real Estate and location value has been a linear progression - from Ikoyi-Lekki-Ikate-Osapa-Chevron-VGC-Ajah-Abraham Adesanya-Sangotedo-Abijo - Awoyaya - Lakowe - Bogije all the way into Ibeju Lekki.

If you want to invest in Real Estate in Nigeria, Click to Call us, or Send a Whatsapp message, or Email us.

Property Rental in prime Locations:

Lagos is such a heterogeneous place that attracts investors, expats, holiday goers, people on official visits and the likes. There is thus a housing deficit of 2million+ and it is ever growing.

The rental industry is struggling to meet up with demand and most people do not want to rent for long or stay in hotels. So the solution? Serviced Apartments!

To this end, alot of developers are positioning their property developments for the market to take advantage of the shortlet market.

And since most of the demand is in Lekki, you can see companies like veritasi, tribitat real estate, God’s Made Homes Luxury positioning in Freedom way Lekki and with an initial deposit between 2m-10m, you can get a 3 bedroom, fully serviced apartment here.

But prime areas do not become prime overnight; most times it does not look like it for years.

For example, when Cosgrove came into Wuye it was abandoned land that other Real Estate companies and developers had run away from. But through an engineering miracle, they turned it around.

You could make a lot of money and save massively on your initial investment by spotting auspicious locations that would do very well in a few years.

You could buy affordably now and maximize your profit when you want to sell, rent or put on the shortlet market.

If you want to invest in Real Estate in Nigeria, Click to Call us, or Send a Whatsapp message, or Email us.

These are other important points you need to note about real estate investment in Nigeria:

6.) Follow areas of government interest

The popular mantra: "Follow the money" is a catchphrase popularized by the 1976 docudrama, " film All the President's Men, " which suggests political corruption can be brought to light by examining money transfers between parties.

It follows that in Real estate business and investment here in Nigeria - you have to keenly follow the government's policy direction and area of interests.

Rivers’ State Case Study

For example, governor Rotimi Amaechi, former executive governor of Rivers State introduced the Greater Port Harcourt Scheme during his tenure.

It prescribed particular areas in the state as areas where the government had particular interest with infrastructural plans to drive development beyond the main city - Port Harcourt to other local governments in Rivers State.

This meant that land value increased in these local governments and there was more paperwork involved in acquiring and perfecting your title in these formerly ‘rural’ areas.

The government now had a blueprint for every single square meter for specific purposes - commercial, residential, roads, hospitals, etc.

In Lagos places like Badagry, Festac, Agege, Ikorodu are not premium real destinations because there is a dearth of government interest and it reflects on perceived property value, demand and supply and investor interests.

7.) Take advantage of Urban areas

Following from the above; Lagos state has deemed Ibeju Lekki as an urban area - this means it has falls under Global acquisition - which means that government has an interest there and plans to undertake massive projects and infrastructure.

Per the Land use act - government 'commits' a large portion of land in these urban areas for its use now or in the future.

The remaining part is free and by a process of regularization/ratification or excision ownership of these free portions can be transferred to ancestral land owners for whatever use they deem fit.

This has made Ibeju Lekki - a once remote location transform to a residential, commercial hub - an eldorado for investments spanning into billions namely; Dangote Refinery, Alaro city, Free Zones, among others.

If you want to invest in Real Estate in Nigeria, Click to Call us, or Send a Whatsapp message, or Email us.

8.) Take advantage of GRAs

In Nigeria, GRA means Government Reserved Areas - can be interpreted to be a euphemism for affluence and a better standard of living.

These exclusive residential areas were originally created to cater to white colonial administrators.

However, after independence, Nigerians began to occupy administrative senior posts that hitherto used to be the exclusive preserve of the white overlords, including their highbrow and secluded GRA residence.

GRAs now are usually a well serviced area with good road network, serviced estates, properly maintained that sometimes has the state's government house here and undoubtedly politicians, celebrities and other influential people in the country.

Lagos has a couple of GRAs in the mainland; Ikeja GRA, Ogudu GRA and the only GRA on the island - Abijo GRA

Investing in a GRA is a good Real estate investment considering that whatever strategy you adopt - rentals, development or flipping; it yields massive returns as these areas are exclusive - so prices are always premium and in demand!

If you want to invest in Real Estate in Nigeria, Click to Call us, or Send a Whatsapp message, or Email us.

9.) Take Advantage of Beachfronts

Lagos Nigeria is flanked by both the Atlantic ocean and the lagoon. With an amazing shoreline and hectares of coastal real estate, you can take advantage of this premium real estate for your beachfronts like VI, Oniru beach and Lekki. Pinnock Beach Estate and Banana island Lagos are popular beachfront estates in Lagos.

Land for sale is available at Pinnock beach estate from NGN180million

If you want to invest in Real Estate in Nigeria, Click to Call us, or Send a Whatsapp message, or Email us.

10.) Take advantage of areas of infrastructural development Plans

Infrastructural projects, construction and developments are variables that affect the value of real estate positively and by Nigerian standards, Lagos is trying! with infrastructural developments, in various stages of completion like:

1.) The Red line Rails: A 37km rail system from Agbado to Marina.

2.) The Blue line Rails: A 27.5km rail system that runs from Marina to Okokomaiko.

3.) The Green Line Rail: An 18km rail system that runs from Lagos Island, traverses Lekki Peninsula and terminates at the location of the proposed Lekki International Airport - it also bifurcates to the Dangote Refinery and Lekki Free Trade zone.

4.) 18.75km Lekki Epe Expressway Project from Eleko junction to Epe T junction. It consists of a 6 lane rigid pavement carriageway that begins from Eleko junction in Ibeju Lekki to Epe T junction, Epe.

5.) 26.7Km Lekki Epe Expressway Project from Eleko Junction to Abraham Adesanya Junction in Eti-Osa axis. This construction is a precursor to the popular 4th mainland bridge.

6.) Construction of 3.75km of road network across 4 roads including; Thompson avenue, Milverton road, McDonald road and Lateef Jakande road.

7.) Ojota - Opebi Link bridge.

8.) Six major junctions improved at Lekki phase 1 and 2, Ajah, Maryland, Ikotun and Allen Avenue with Traffic light signal (TSL) technology.

9.) 10km long Lekki Regional Road network which covers districts from Victoria Garden City scheme 1 to Lekki Freedom way.

10.) 1.4km long Agege/Pen Cinema flyover bridge.

If you want to invest in Real Estate in Nigeria, Click to Call us, or Send a Whatsapp message, or Email us.

11.) Take advantage of Free Trade Zones

Free zones are special economic zones in a country where there is minimal to no interference from Federal, state and local government authorities.

It is heavily driven by the private sector, so lots of the bottlenecks and bureaucracy involved in commerce - exports and imports and local trade is bypassed.

As a result, free zones are largely attractive to international and local investors and drive massive foreign direct investment (FDI).

Nigeria has some of such free zones like;

- Eko Atlantic

- Alaro city

- Free Trade Zone by LFZDC (Lekki Free Zone Development Company)

- Dangote Refinery

Some of the benefits of the companies located in these special economic zones - Free zones called Free Zone Enterprises (FZEs) include:

- Zero withholding tax on dividends.

- Zero corporate income tax on free zone income.

- Zero VATs on purchases made within the free zone.

- Zero custom duties on imports

- Exemption of Fx controls and de-dollarization policies.

- No strikes, long stay of goods in the ports.

The largest Deep-Sea Port in West Africa is currently under construction and located to the south of the Free Zone by Lekki Free Zone Development Company (LFZDC).

A bridge links Alarocity; another Free zone; to other Free zones namely Dangote Refinery and the Freezone by LFZDC.

Already, there are a combined number of 300 private businesses in Eko Atlantic, Alaro City, Free Trade Zone by LFZDC; that are registered free zone enterprises in the different Free zones in Lagos already poised to benefit from these amazing benefits.

If you want to invest in Real Estate in Nigeria, Click to Call us, or Send a Whatsapp message, or Email us.

12.) Buy into Mega city projects early

Lagos is bustling - a Real Estate hub with hundreds of Real Estate projects springing up every other month.

But some of these projects tend to stand out. Maybe it's more about the scale, ambition, services and amenities to be provided, the planning, but these Real Estate projects hardly ever come unannounced!

Just like banana island - they start very small and in years they are premium, exclusive communities that pay massively to investors!

Some of these mega projects, in different stages of completion include:

- Isimi Lagos by Landwey

- Dukia Africa in Epe by Landmark Homes and Properties.

- Itunu Residential and Itunu City by Veritasi homes.

- Lakowe Lakes Golf and Country /Estate by Mixta Africa

- Aurora Campo by FWC

- Eko Atlantic by Southern Energy X

Depending on how early you can spot these projects, these are no-brainer, sure, guaranteed Real Estate investments that would pay huge dividends, and no matter what time you enter, you are guaranteed your returns!

If you want to invest in Real Estate in Nigeria, Click to Call us, or Send a Whatsapp message, or Email us.

How to fund Real Estate Investments in Nigeria

Knowing the above above Real Estate Investments - how do you fund these projects? There are several methods you can deploy which include:

i .) Out of pocket

The most common and most intuitive in this part of the world, you can easily fund Real Estate projects from savings and salary depending on your pocket and the scale - there is something for every pocket and every size!

ii.) Take Advantage of Payment Plans

You may not be able to shell out millions immediately out of pocket but there are different payment plans you can take advantage of.

After putting down a stipulated payment - a fraction of the cost, you can spread the remaining payments, for a month, three months, six, 12, 24, even 2-4 years.

Most times these come with a little interest attached after the third month, but some are even interest free, up to 4 years! like Landwey's development at Oworonshoki.

iii.) Bank Loans

Maybe not so popular with individuals but lots of Real estate developers and companies take advantage of this method. It's all about OPM (other people's money) and channeling it to Real Estate projects.

Banks even in this part of the world that are usually not poised to give people and businesses loans gladly bring their cheque books out for Real Estate developments and projects.

The interest rate might be a conversation for another day, but most companies meet up, even after taking profits from their Real Estate Investment projects.

iv.) Cooperatives

This is very popular in Lagos, as groups of individuals, companies, and organizations come together to pool funds together and fund real estate projects. There is flexibility in the payment terms and as a group they can purchase land in bulk, start development simultaneously and secure the land, rather than doing it as a lone ranger among so many wolves!

A popular co-operative in Lagos is the Chevron cooperative - with a long list of investments in their real estate portfolio namely; Nicon town estate, Chevron Drive, Northern Foreshore estate and a couple of estates in Abijo GRA and opposite Fairfield Apartments Abijo.

v.) Sponsorship deals

Ancestral land owners (also called omo ni ‘ile) with a bulk amount of land usually don't have money to develop so every now and then when they want to raise money for themselves, they partner with developers and sponsors to develop and sell their land.

This is a method called sponsorship.

In turn they offer you plots as compensation, commensurate to the volume of land you do work on.

This is how big companies like Landwey, Pwan, Veritasi, Revolution Plus and other companies get bulk land in Ibeju Lekki and Epe.

If you want to invest in Real Estate in Nigeria, Click to Call us, or Send a Whatsapp message, or Email us.

vi.) Joint Ventures (JVs)

Joint Ventures are another way to fund Real Estate Businesses and investments. They are usually two, three or more parties involved;

The owner of the land (usually owned in a prime area or a massive expanse). The developer that is interested in developing and putting infrastructure on the land/property. The investor; most times the developer and investor are the same, but other times, the investor pools funds together to either implement the project, or contribute to the project for an expected return when the property is sold or rented.

If you want to invest in Real Estate in Nigeria, Click to Call us, or Send a Whatsapp message, or Email us.

Also check out: houses for sale in wuye abuja, houses for sale in guzape abuja, Cosgrove Katampe, Mabushi Abuja, Cosgrove Abuja, Banana island Lagos, Sangotedo, Oniru, Epe, Kubwa.

Frequently Asked Questions About Real Estate Investment in Nigeria

Is Real Estate Profitable in Nigeria?

Yes. Real Estate is very profitable in Nigeria aside tech that is now a valuble way to earn in dollars. Real Estate has been on an upward trend compared to other parts of the economy, attracting investments from both locals, foreigners, government and expats. It is still growing rapidly as an industry with a huge market/housing deficit.

What is the Best Investment to Make in Nigeria?

Some of the best investments to make in Nigeria include:

- Cryptocurrency

- Real Estate Investment

- Government Bonds (treasury Bills)

- Shares

- Forex Trading

- Agricultural Investments

Can a Foreigner Buy Property in Nigeria?

Technically yes. You can get in on the Real estate pie no matter your location or nationality. You can do this by: 1.) Hiring a lawyer and giving them the power of attorney over your estate to purchase on your behalf.

2.) Apply for a governor's consent at the land registry for the interested property in question.

3.) Incorporate a business in Nigeria and acquire as much properties under the business name with no encumbrances.

How Much is Real Estate Worth in Nigeria

The Gross Domestic Product (GDP) of the Real Estate Services (nominal terms) has increased by 10.84% in the first quarter of 2022. It is higher by 2.79% points than the growth rate recorded within the same period in 2021. This is compared to 2020, where the GDP of the Nigerian real estate industry was ₦3.96 trillion, a 9.4% decline from the prior year’s ₦4.37 trillion.

Get in touch

Share This Property

Other blog posts

Estates

6 min read

Dukia Africa: 20 Reasons To Buy - All You Need To Know About Biggest Resort Estate in Africa

Uche Emordi

Digital Lead and Webmaster

Estates

7 min read

Pinnock Beach Estate: All You Need To Know

Uche Emordi

Digital Lead and Webmaster

Estates

1 min read

Complete Review: Isimi Lagos by Landwey in Epe Wellness and Sustainable City Should You Invest Here?

Uche Emordi

Digital Lead and Webmaster